Investment Focus

By providing tailored credit solutions to companies within any industry, Travelers Capital aims to support businesses access untapped liquidity from their balance sheets and support management by providing unconventional refinancing solutions that assist with the execution and acceleration of their turnaround or growth initiatives

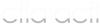

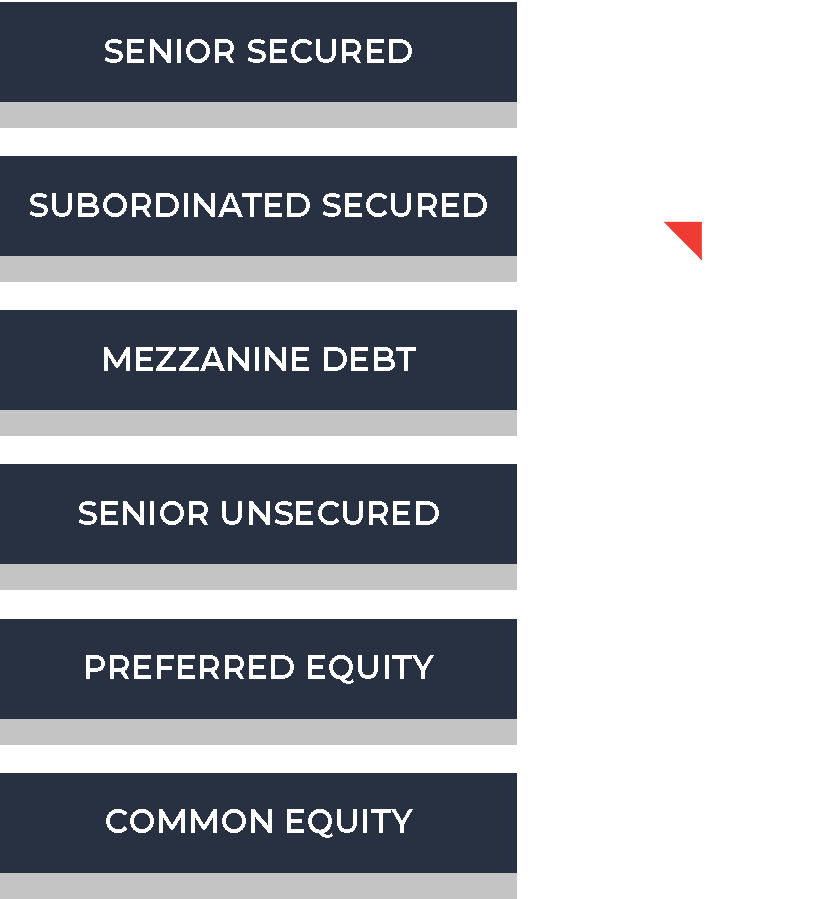

Capable of providing capital across the risk spectrum TCC is a true transition lender with the ability to assist borrowers with near-term liquidity constraints, balance sheet restructuring & consolidation facilities, near-distress & distressed solutions, and rapid-growth capital support.

Travelers Capital target’s debt investments from $500k to $25 million, with the ability to close larger transactions as required. By underwriting a company’s enterprise value and off-balance sheet equity, TCC is also able to supplement senior debt investments with secondary liens & mortgages, mezzanine tranches, and third party guarantees to alleviate credit risk and shape workable financing terms.

Capital Solutions

Asset-Based Bridge Loans

Structured financing solutions for terms ranging between 3 – 72 months

Leveraged Finance

M&A and LBO Financing

MBO Facilities

Dividend Recapitalizations

Mezzanine Financing

Equipment Finance

Operating Leases

Capital Leases

Sale & Leasebacks

Specialty Asset Finance

Restructurings

Debt Consolidation Facilities

Recapitalization Facilities

Interest-Only and Seasonal Repayment Facilities

Unitranche Facilities

Short & Long-Term Credit Facilities

Single-asset Refinancing

Cross-Collateralized CAPEX

Distressed Debt Solutions

DIP & Exit Finance

Special Situation Loans

Travelers Capital. All Rights Reserved ©

A division of the Travelers Financial Group, a Canadian privately held non-bank lender

The member of:

Investment Focus

By providing tailored credit solutions to companies within any industry, Travelers Capital aims to support businesses access untapped liquidity from their balance sheets and support management by providing unconventional refinancing solutions that assist with the execution and acceleration of their turnaround or growth initiatives

Capable of providing capital across the risk spectrum TCC is a true transition lender with the ability to assist borrowers with near-term liquidity constraints, balance sheet restructuring & consolidation facilities, near-distress & distressed solutions, and rapid-growth capital support.

Travelers Capital target’s debt investments from $500k to $25 million, with the ability to close larger transactions as required. By underwriting a company’s enterprise value and off-balance sheet equity, TCC is also able to supplement senior debt investments with secondary liens & mortgages, mezzanine tranches, and third party guarantees to alleviate credit risk and shape workable financing terms.

Capital Solutions

Asset-Based Bridge Loans

Structured financing solutions for terms ranging between 3 – 72 months

Equipment Finance

Operating Leases

Capital Leases

Sale & Leasebacks

Specialty Asset Finance

Short & Long-Term Credit Facilities

Single-asset Refinancing

Cross-Collateralized CAPEX

Leveraged Finance

M&A and LBO Financing

MBO Facilities

Dividend Recapitalizations

Mezzanine Financing

Restructurings

Debt Consolidation Facilities

Recapitalization Facilities

Interest-Only and Seasonal Repayment Facilities

Unitranche Facilities

Distressed Debt Solutions

DIP & Exit Finance

Special Situation Loans

Travelers Capital. All Rights Reserved ©

A division of the Travelers Financial Group, a Canadian privately held non-bank lender

The member of: