Investment Focus

By providing tailored credit solutions to companies within any industry, Travelers Capital aims to support businesses access untapped liquidity from their balance sheets and support management by providing unconventional refinancing solutions that assist with the execution and acceleration of their turnaround or growth initiatives

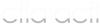

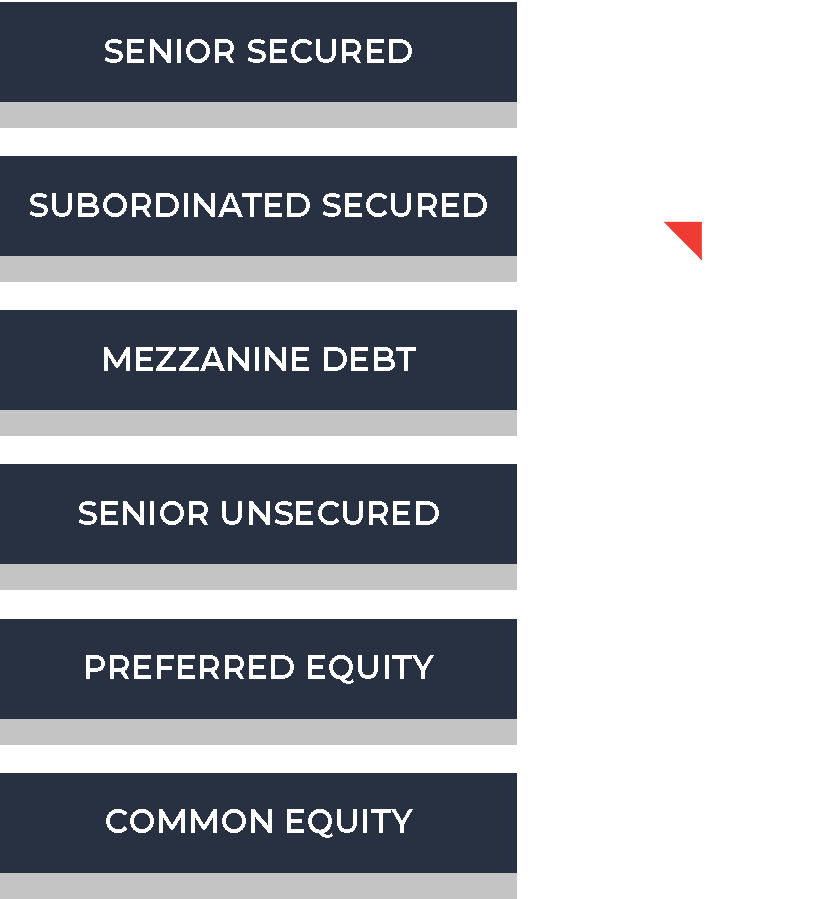

Capable of providing capital across the risk spectrum TCC is a true transition lender with the ability to assist borrowers with near-term liquidity constraints, balance sheet restructuring & consolidation facilities, near-distress & distressed solutions, and rapid-growth capital support.

Travelers Capital target’s debt investments from $500k to $25 million, with the ability to close larger transactions as required. By underwriting a company’s enterprise value and off-balance sheet equity, TCC is also able to supplement senior debt investments with secondary liens & mortgages, mezzanine tranches, and third party guarantees to alleviate credit risk and shape workable financing terms.

*All investments made or considered by Travelers Capital Corp. are subject to a thorough due diligence and underwriting process and are made at the sole discretion of the general partner or investment committee of the Travelers Capital Private Credit Fund. The fund does not guarantee the availability of financing, and all terms are subject to change based on market conditions, asset quality, and borrower profile. Nothing on this website constitutes an offer to lend or a commitment to invest. Any financing or investment is made in accordance with the fund’s governing documents and applicable laws. Investor introductions to the Travelers Capital Private Credit Fund are permitted exclusively through registered exempt market dealers. Travelers Capital Corp. has retained Belco Private Capital Inc. (“Belco”) as its registered exempt market dealer. If you would like to learn if this investment is suitable for you then please contact Anna Szabo, a registered dealing representative with Belco, at anna@belcopc.co

Capital Solutions

Asset-Based Bridge Loans

Structured financing solutions for terms ranging between 3 – 72 months

Leveraged Finance

M&A and LBO Financing

MBO Facilities

Dividend Recapitalizations

Mezzanine Financing

Equipment Finance

Operating Leases

Capital Leases

Sale & Leasebacks

Specialty Asset Finance

Restructurings

Debt Consolidation Facilities

Recapitalization Facilities

Interest-Only and Seasonal Repayment Facilities

Unitranche Facilities

Short & Long-Term Credit Facilities

Single-asset Refinancing

Cross-Collateralized CAPEX

Distressed Debt Solutions

DIP & Exit Finance

Special Situation Loans

Travelers Capital. All Rights Reserved ©

A division of the Travelers Financial Group, a Canadian privately held non-bank lender

The member of:

Investment Focus

By providing tailored credit solutions to companies within any industry, Travelers Capital aims to support businesses access untapped liquidity from their balance sheets and support management by providing unconventional refinancing solutions that assist with the execution and acceleration of their turnaround or growth initiatives

Capable of providing capital across the risk spectrum TCC is a true transition lender with the ability to assist borrowers with near-term liquidity constraints, balance sheet restructuring & consolidation facilities, near-distress & distressed solutions, and rapid-growth capital support.

Travelers Capital target’s debt investments from $500k to $25 million, with the ability to close larger transactions as required. By underwriting a company’s enterprise value and off-balance sheet equity, TCC is also able to supplement senior debt investments with secondary liens & mortgages, mezzanine tranches, and third party guarantees to alleviate credit risk and shape workable financing terms.

*All investments made or considered by TCC Financial Inc. are subject to a thorough due diligence and underwriting process and are made at the sole discretion of the general partner or investment committee of the Travelers Capital Private Credit Fund. The fund does not guarantee the availability of financing, and all terms are subject to change based on market conditions, asset quality, and borrower profile. Nothing on this website constitutes an offer to lend or a commitment to invest. Any financing or investment is made in accordance with the fund’s governing documents and applicable laws. Investor introductions to the Travelers Capital Private Credit Fund are permitted exclusively through registered exempt market dealers. Travelers Capital Corp. has retained Belco Private Capital Inc. (“Belco”) as its registered exempt market dealer. If you would like to learn if this investment is suitable for you then please contact Anna Szabo, a registered dealing representative with Belco, at anna@belcopc.com

Capital Solutions

Asset-Based Bridge Loans

Structured financing solutions for terms ranging between 3 – 72 months

Equipment Finance

Operating Leases

Capital Leases

Sale & Leasebacks

Specialty Asset Finance

Short & Long-Term Credit Facilities

Single-asset Refinancing

Cross-Collateralized CAPEX

Leveraged Finance

M&A and LBO Financing

MBO Facilities

Dividend Recapitalizations

Mezzanine Financing

Restructurings

Debt Consolidation Facilities

Recapitalization Facilities

Interest-Only and Seasonal Repayment Facilities

Unitranche Facilities

Distressed Debt Solutions

DIP & Exit Finance

Special Situation Loans

Travelers Capital. All Rights Reserved ©

A division of the Travelers Financial Group, a Canadian privately held non-bank lender

The member of: